Trading

Dezentralized Trading with JENCO and MT4 Real-time Access to Market Prices and Liquidity MT4 allows traders to access forex quotes in real-time and execute trades. Along with the security symbol, the real-time bid/asl quote is also displayed. Multiple Trading Orders for High Flexibility While it is associated with Forex, it’s used to trade other markets, […] MORE INFO

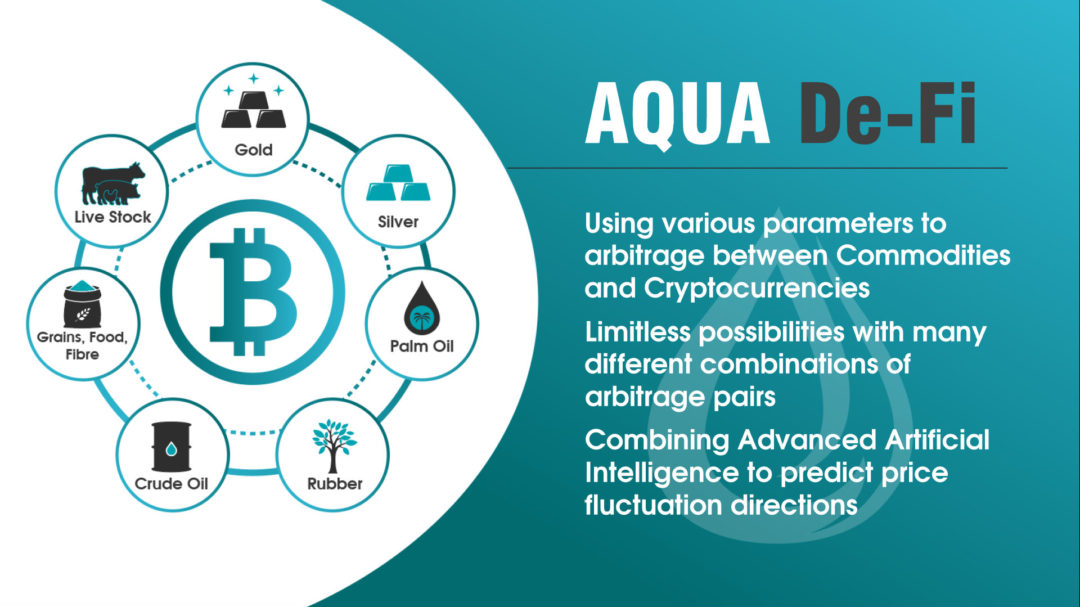

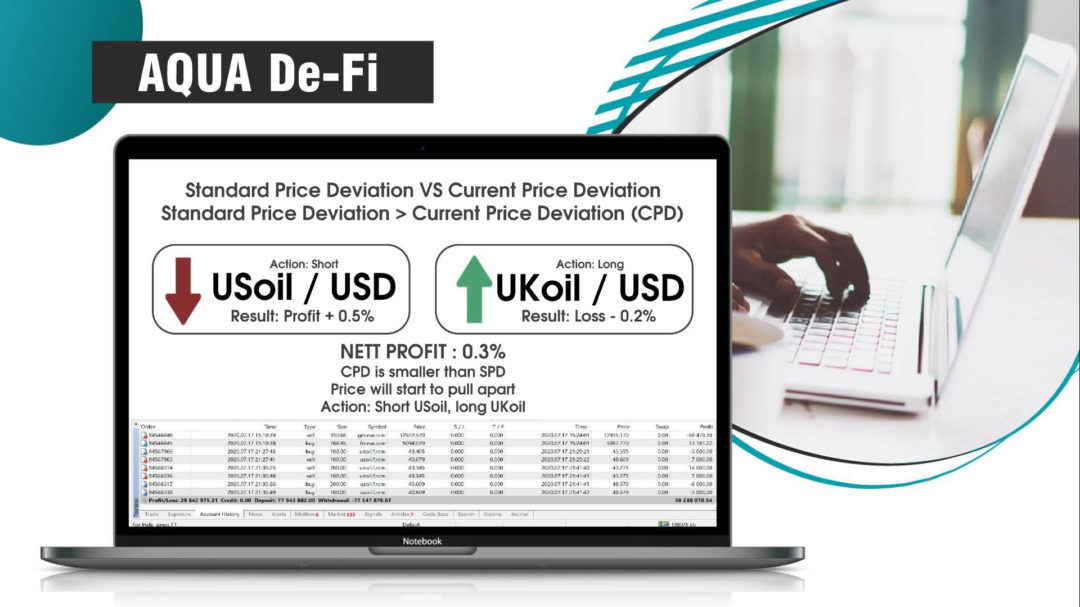

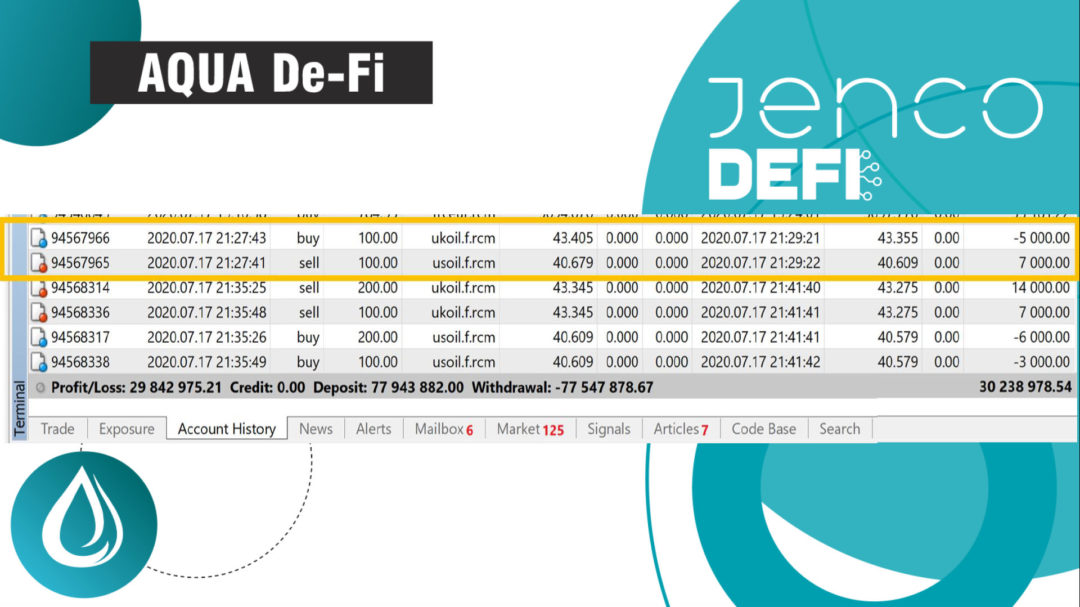

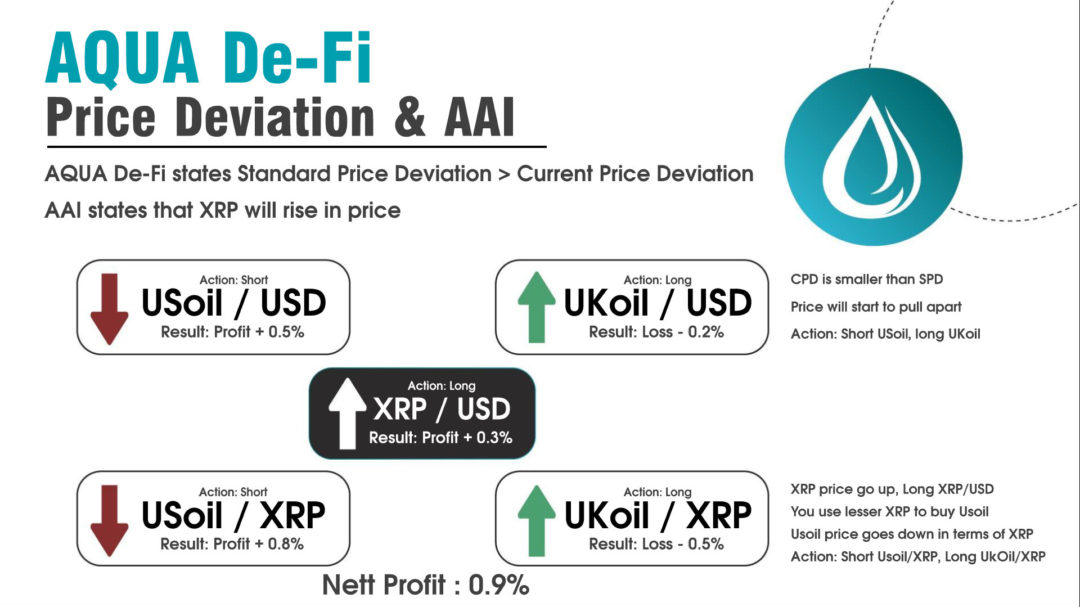

Arbitrage

What is Arbitrage? Wikipedia defines arbitrage as follows: “Arbitrage is the practice of taking advantage of a price difference between two or more markets: striking a combination of matching deals that capitalize upon the imbalance, the profit being the difference between the market prices at which the unit is traded. When used by academics, an […] MORE INFO

About JENCO

JENCO Limited, founded in Hong Kong in 2020 is a decentralized finance platform that provide users with traditional financial services but in a decentralized, borderless manner that enables anyone across the globe with an internet connection to gain access to financial products and services.

JENCO Limited is a subsidiary of Jubilee Group Limited with the aim of bridging the gap between the commodities market and the cryptocurrency market. With the increasing popularity of decentralized finance, JENCO Limited takes advantage of the benefits of decentralized finance and opens up limitless opportunities for cryptocurrency investors to profit from the commodities market.

JENCO is the powerhouse behind Jubilee Group Limited that will strengthen their stronghold in the financial industry with their cutting edge decentralized finance platform.

Jubilee Ace Success

- 20 months of operations

- More than 100,000 users worldwide

- Over 900 million USD of subscription

- Stable arbitrage profits of 30% to 40% per month

- Birth of Aquanite (local token ecosystem)

JENCO

- Second expansion of Jubilee Group

- Focused on building decentralized finance (de-fi) network

- Combinding Commodities with Cryptocurrencies for bigger arbitrage opportunities

- Incorporation De-fi lending and loan systems

- True Arbitrage for the unbanked

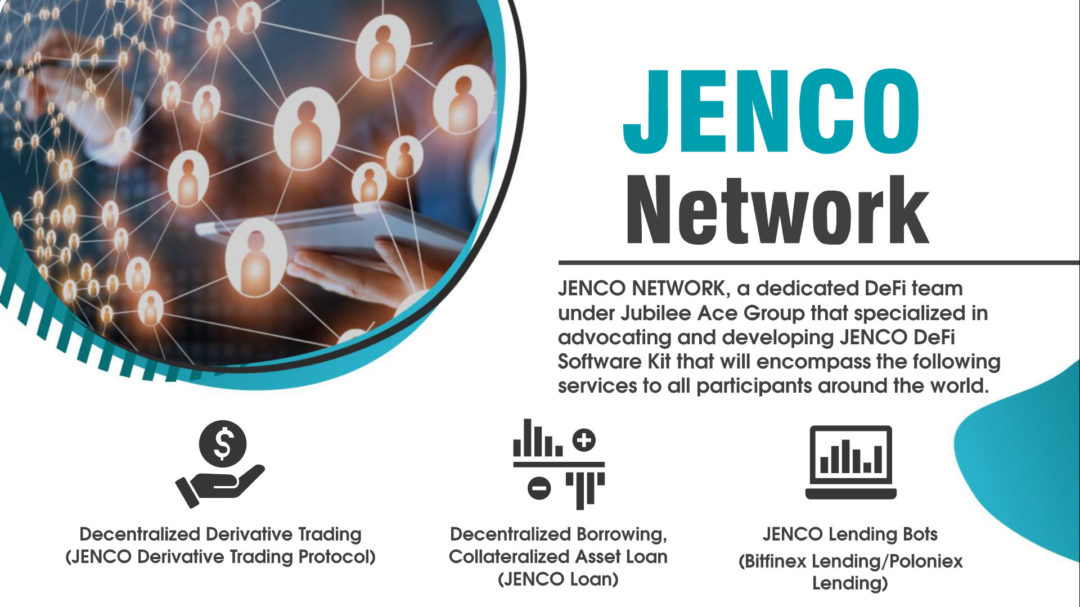

Network

JENCO NETWORK, a dedicated DeFi team under Jubilee Ace Group that specialized in advocating and developing JENCO DeFi Software Kit that will encompass the following services to all participants around the world.

Traditional Finance

vs Decentralized Finance

- Traditional finance system relies on institutions such as banks to act as intermediaries while DeFi platform-based application does not need any third party; thus, users maintain control over their funds at all times.

- In DeFi, there is no single point of failure as financial services are deployed on top of blockchains while traditional finance system suffers from bottleneck issues.

- As DeFi is an open ecosystem, it allows individuals to access their financial records easily, unlike traditional finance systems.

- Decentralized exchanges have lower trading fees as it reduces the associated costs and allows for a more frictionless financial system compared with centralized exchanges.

Benefits of Decentralized Finance

Secure and Improved Cross Border Payments

DeFi offers open lending protocols, which are the most popular types of applications that make decentralized lending and borrowing process much easier.

From instant transaction settlement to the ability to collateralize digital assets and no credit checks, DeFi improves international money transfers. Lending and borrowing marketplaces on the blockchain help in reducing counterparty risk, and also makes the entire process cheaper and faster.

Decentralized Exchanges

DeFi applications support decentralized exchanges as these platforms allow users to trade digital assets without needing any trusted intermediary to hold their funds as such trades operate directly between user wallets by smart contracts. There is very little maintenance work in decentralized exchanges, thus possesses comparatively lower trading fees than traditional exchanges.

DeFi connects lenders with borrowers easily, thus allowing credit checks and digital assets to be transferred speedily and easier.